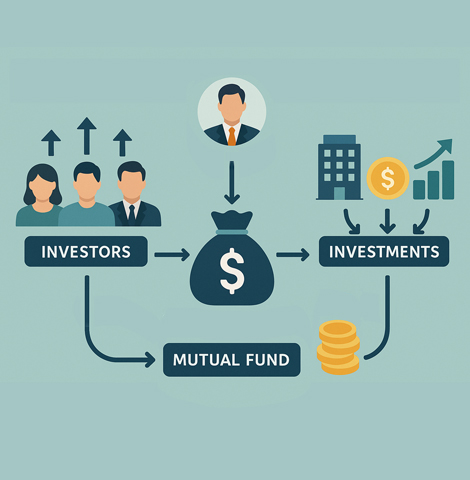

A mutual fund is simply a financial intermediary that allows a group of investors to pool their money together with a predetermined investment objective. The mutual fund will have a fund manager who is responsible for investing the pooled money into specific securities (usually stocks or bonds).

A mutual fund is a collection of stocks, bonds, or other securities owned by a group of investors and managed by a professional investment company. For an individual investor, having a diversified portfolio is difficult.

A mutual fund is a collection of stocks, bonds, or other securities owned by a group of investors and managed by a professional investment company. For an individual investor, having a diversified portfolio is difficult.